US Taxes for Americans Living Abroad

US taxes for Americans living abroad can be relatively complicated. With some knowledge and planning, however, one can take advantage of the IRS tax code to their benefit. This article provides the foundation for the broad range of topics that comprise US expat taxation. The topics we cover include:

- Filing requirements

- Foreign earned income exclusion

- Foreign housing exclusion

- Foreign tax credit

- Social Security (FICA) taxes

- FBAR – Foreign Financial Account Report

- FATCA – Foreign Account Tax Compliant Act

- US state tax returns

US Taxes for Americans Living Abroad – Ultimate Guide

US Tax Filing Requirements for Americans Living Overseas

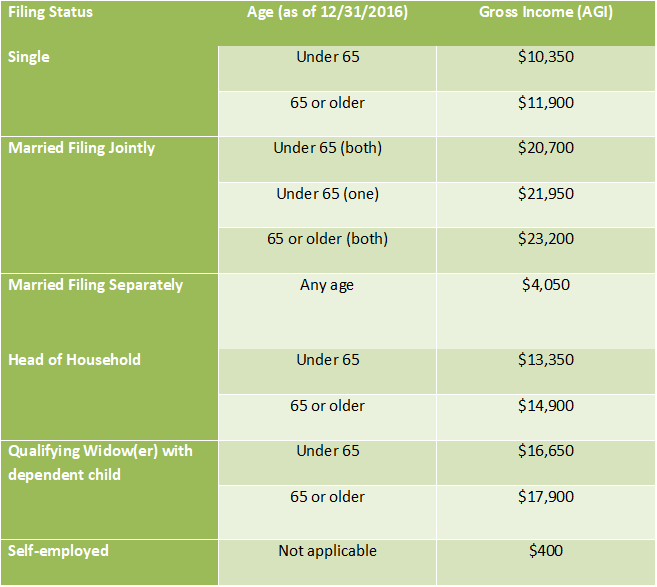

US citizens and permanent residents (Green Card holders) are generally required to file US tax returns regardless of the location or source of the income, provided that the income is above the minimum threshold as detailed below.

As mentioned already, US expats are required to report worldwide income. Unfortunately, many are not aware of this fact, and do not file. With the aggressive implementation of FATCA (Foreign Account Tax Compliance Act), the IRS now has a lot more information regarding the financial activity of US persons in foreign countries. The risk of non-filing is undoubtedly increasing.

Is there a reason to file taxes – even if you’re not required?

Even if there is no obligation to file based on the income thresholds, many expats should consider filing a tax return in order to receive special tax credits/refunds. For example, families with a child or children (<17 years of age) may be eligible for the Child Tax Credit, which is worth up to $1,000 per child.

Secondly, filing a tax return starts the clock on the IRS statute of limitation. Generally speaking, the IRS has 3 years to audit a tax return (6 years if substantial income is not reported). Not filing a tax return may also result in potential inquiries and audits by the IRS – something better to be avoided.

Foreign Earned Income Exclusion

U.S. citizens and permanent residents are subject to U.S. income tax on worldwide income – it doesn’t matter where you generate your income. Fortunately, the U.S. government offers an important tax relief to Americans living and working abroad (to alleviate the burden of double taxation).

- For 2018, up to $104,100 of foreign earned income earned while living abroad can be excluded from federal tax;

- You must either meet the bona fide residence or physical presence test (explained below)

- Individuals who work abroad for the U.S. government are not eligible

Foreign earned income excludes any U.S. based income including pension and other retirement or deferred income. It also excludes any foreign income that was not earned (e.g., interest, dividends, rental income, pension). For self-emp[oyed individuals, self-employment tax continues to be in effect.

Bona fide residence and physical presence tests:

- The bona fide residence test is met if you have an established “residence” within a foreign country and have lived there during an entire calendar year. Furthermore, your intentions must be to remain in that country.

- The physical presence test is met if you are outside the U.S. for 330 out of 365 consecutive days.

For more information, click on foreign earned income exclusion.

Foreign Housing Exclusion

In addition to the Foreign Earned Income Exclusion (FEIE), some expats are able to deduct a portion of their housing costs. The intent of the foreign housing exclusion is to recognize that housing costs abroad may be higher than in the United States. To qualify, you must meet either the bona fide residence or physical presence test. The foreign housing exclusion amount is based on (1) where you live, and (2) how many days you lived outside the U.S. during the tax year.

For more information, click on foreign housing allowance

Foreign Tax Credit

The foreign tax credit (FTC) offsets certain foreign taxes paid against US tax obligations. It is a useful option for US expats who live in a country with higher tax rates than the United States. Otherwise, the foreign earned income exclusion probably makes more sense. Unlike with the foreign earned income exclusion, there is not a bono fide residence or physical presence test requirement.

Taxes paid to other countries qualify for the foreign tax credit when:

- They were levied on your income;

- You were legally obliged to pay them;

- You did pay them;

- You did not gain from paying them; and

- The United States has not sanctioned the country

Important to note: The FTC is limited to US tax obligations on foreign income only. The useable credit may not exceed a taxpayer’s US income tax liability prorated for the percentage of foreign income to total income (including US-source income). Any unused FTC may be carried back to a previous tax year, or carried forward to a future tax year. You can carry-back the foreign tax credit to the immediately preceding tax year, or carry-forward the credit for the next 10 tax years.

For more information, click on foreign tax credit.

Social Security (FICA) Taxes

US expats who are employed by a US company are obligated to pay Social Security tax (automatically withheld from pay). However, your host country may also require social security taxes. To resolve the double taxation issue, there are a few countries that have Social Security Agreements with the United States. These agreements spell out whether an individual is subject to the US Social Security taxes, or whether the person is subject to the social security taxes of the foreign country.

As of the publication of this booklet, the following countries have Social Security Agreements with the United States.

For more information, click on Totalization Agreements.

Foreign Financial Account Report (FBAR or FinCen 114)

The U.S. government is increasingly interested in knowing about the foreign assets held by its citizens and residents. The FBAR (Foreign Financial Account Report) is one of the key reporting requirements that Uncle Sam utilizes in its monitoring efforts. FATCA (Foreign Account Tax Compliant Act) is a second and distinct requirement. US expats often get these two confused with one another.

What are the FBAR requirements?

U.S. citizens, permanent residents and legal entities (e.g., U.S. corporations, partnerships, LLCs) with an interest or signature authority over foreign financial accounts that have an aggregate balance exceeding $10,000 are required to file the FBAR.

- Foreign financial accounts or assets include: banks accounts, brokerage accounts, mutual funds, annuities, life insurance policies with cash value, and indirect interests in foreign financial assets through an entity (if >50% ownership);

- The threshold is met if the aggregate balance (combining all the accounts) exceeds $10,000 at any point during the year;

- The FBAR is a separate from your income tax filing;

- The due date is tied to the tax filing deadline

To complete the FBAR, it is advisable to maintain records of your monthly account balances. Otherwise, the paperwork may become a difficult exercise. Account balances need to be converted to USD using the F/X rate as of the last day of the year. Failure to report (non-willful) carries a penalty up to $10,000. Willful non-compliance potentially raises the penalty up to $100,000 or 50% of the taxpayer’s foreign assets (whichever is greater).

The FBAR is an electronic filing with the US Treasury Department. Officially, the FBAR is called FinCen 114 (Financial Crime Enforcement Network).

Foreign Account Tax Compliant Act (FATCA)

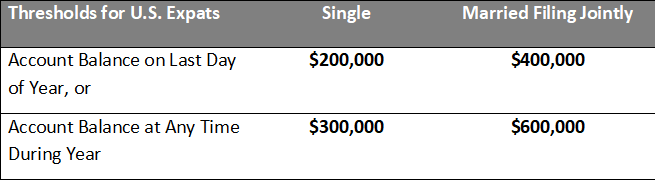

U.S. persons who own foreign financial accounts that have an aggregate balance exceeding certain thresholds (see below) are required to file Form 8938, which is included with one’s tax return.

- US persons include citizens, permanent residents, and non-residents that file a joint tax return with a US citizen.

- Foreign financial accounts or assets include: banks accounts, brokerage accounts, mutual funds, annuities, life insurance policies with cash value, and financial interest in a foreign partnership

The maximum penalty for failing to file Form 8938 is $60,000 for each foreign asset that you failed to report (even more onerous than for the FBAR).

FATCA – Intergovernmental Agreements

The US government is inking deals with other countries whereby foreign financial institutions (FFIs) will be required to:

- Identify accounts of US persons;

- Report certain information to the IRS regarding those accounts;

- Withhold a 30% tax on certain payments to account holders unwilling to provide the required information

As of the publication of this booklet, over 100 countries have either signed intergovernmental agreements with the United States or are in discussions.

US State Tax Returns

Many US expats assume that state tax filing obligations go away once they move abroad. Unfortunately, that is not always true. There are certain states that have stiff rules that regulate residency status. California is an extreme example. Some of the factors that determine CA residency include:

- State that issued your driver’s license

- State in which you maintain professional license(s)

- State in which you are registered to vote

- Location of banks where you maintain accounts

- Location of your medical professionals, accountants, attorneys

Furthermore, California has an aggressive stance on what constitutes income taxable by the state. Residents are taxed on all income. Non-residents are taxed on income from California sources (distributions from pensions and other qualified plans are an exception). Even more onerous, California does not allow the foreign tax credit or foreign earned income exclusion.

Fortunately, most other states are less aggressive. The best states to have been a resident prior to expatriating are: Wyoming, Washington, Texas, South Dakota, Nevada, Florida and Alaska. None of these collect income tax from their residents (including expatriates from the state).

The rules vary state-by-state. However, leaving dependents or property ownership could keep your residency status tied to many states.

For more information on US taxes for Americans living abroad, go to our full library of articles on the subject.