Child Tax Credit – How to Qualify

The child tax credit is a great benefit provided by the US government to American families with children under the age of 17. The credit or “tax refund” can be worth up to $1,000 per child (increases to $1,400 starting 2018), even if you did not pay any US taxes toward that particular year. Most households with moderate income can qualify for this benefit. However, one must file a tax return in order to claim the refund.

Child Tax Credit – Example

- Family with 2 small children

- One parent (US person) earns income of $20K

- Other parent (non-US person) earns income of $25K – not reported on US tax return

- US parent files tax return – reporting $20K in income

Families that qualify for the child tax credit can back file up to 3 years – the refund amount can be considerable.

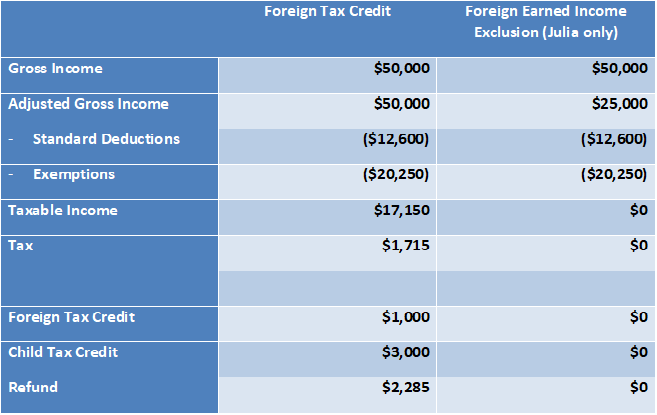

Effective 2015 tax year, the rules have changed with respect to the child tax credit, when the foreign earned income exclusion (FEIE) is exercised. The presence of the FEIE on a tax return invalidates the refundable child tax credit. A potential work-around is to file separate returns (when both parents are US persons), with the lower-earning parent reporting the children on his/her return. While this approach is slightly more complicated, it preserves the child tax credit in many instances.

One final point: To claim the child tax credit, one needs to have a social security number for each child. Obtaining a social security number in the US is the easiest option, and can often be done within a day or two.

For general information on US expat taxation, please read: US Taxes for Americans Living Abroad – Ultimate Guide.