College Planning (529 Plans) and US Expats

You got kids. They may be small now, but before you know it, they’re off to college. Unfortunately, the cost of a university degree in the United States has become incredibly daunting. Therefore, planning for college expenses is imperative, and getting an early start provides an absolute advantage. Learn about how 529 plans may be a great vehicle for saving.

College Planning and US Expats

According to the College Board, the average cost of tuition and fees for a private university in the United States is slightly over $30,000 per year (excluding room and board). Public schools are more affordable, but still clock in at over $22,000 per year (out-of-state tuition). Furthermore, every year the cost of tuition increases at a rate much higher than inflation.

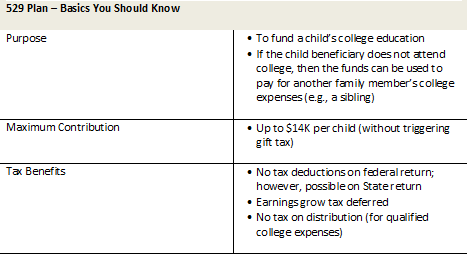

In this article, we discuss 529 plans for US expats. A 529 plan is basically a savings account established for the purpose of funding a college education. There are two types of 529 plans; however, the main ones are sponsored by individual States.

Why 529 plans are great

From a tax advantage, there are clear advantages. Account balances grow tax deferred. And when the proceeds are used to pay for qualified college expenses, there are no tax consequences. So if you can afford to save for college, a 529 plan is a fantastic vehicle.

For US citizens living abroad, setting up a 529 plan can be slightly tricky. That is because many expats do not have residency in a particular state. In these cases, we recommend establishing a 529 plan with Vanguard (the largest mutual fund companies in the world). Vanguard 529 College Savings Plans are sponsored by the State of Nevada, but is open to any investor. Vanguard is renowned for its low fee structure, so more of your money goes toward covering college expenses. For more information, go to: https://investor.vanguard.com/

For general information on US expat taxation, please read: US Taxes for Americans Living Abroad – Ultimate Guide.