Tax-Efficient Investing

Simply put, tax-efficient investing means structuring your investments such that taxes are minimized. This relates to an important saying: “It’s not what you earn, but what you keep.”

Tax-Efficient Investing

Investments generate returns – capital gains, dividends, and interest. Generally speaking, capital gains are more tax efficient than dividends and interests. That is because capital gain can be deferred until the investment is sold, and long-term gains are subject to a lower tax rate. However, there are certain mutual funds and managed accounts (by financial advisors) with high churn or turnover – lots of buying and selling within the fund or portfolio. These generate distributed capital gains on which the investor needs to pay taxes. People are often surprised by the large capital gains that appear in their year-end statements from their mutual fund companies or brokerage firms.

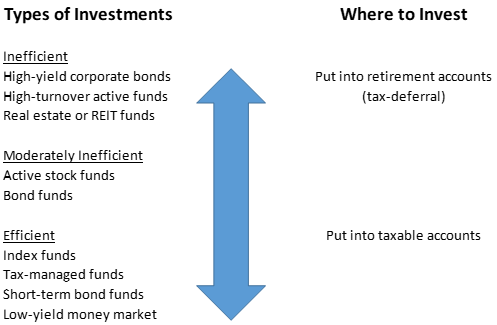

Therefore (as a general rule), you should structure your investment portfolio into two buckets:

1. Put “less tax-efficient” investments into retirement accounts; and

2. Put “more tax-efficient” investments into taxable accounts

They say a picture (or a chart) is worth a thousand words:

Tax-efficient investing does not factor individual circumstances. For example, if you needed access to funds for a planned expenditure, then putting those funds into a retirement account may not make sense. Furthermore, many retirees face an entirely different set of questions in order to minimize their tax bill.

For general information on US expat taxation, please read: US Taxes for Americans Living Abroad – Ultimate Guide.