Japan and US Expat Tax Return

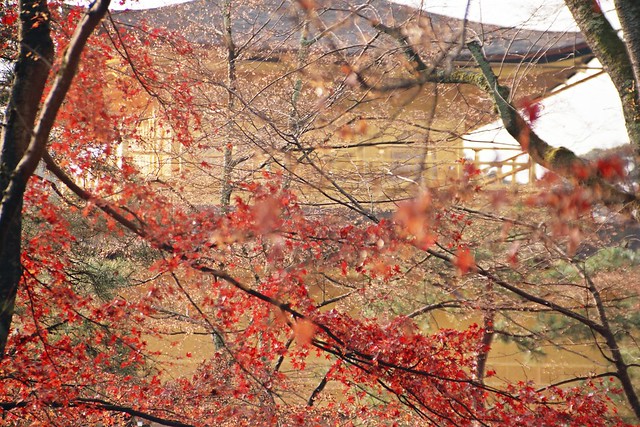

Japan is often referred to as the “Land of the Rising Sun.” It is a magnificent place filled with contrasts – ancient traditions co-exist with cutting edge technology.

If you are planning to become a U.S. expat in Japan, or have been one for a while, it’s important to know the tax laws of the country and the potential impact on your U.S. tax return. Expat taxes can get complicated. Fortunately, we have outlined the key points below.

Photo by: Marc Veraart

Taxation in Japan

Let’s start by understanding who is required to pay taxes in Japan. There are two categories of residency status:

- Permanent residents – Japanese nationals and foreigners who have lived in the country for 5 or more years during past 10 years; and

- Non-permanent residents – Foreigners who have lived in Japan at least one year, but less than 5 years (this category also includes foreign nationals on employee contracts).

Permanent residents are taxed on worldwide income. Non-permanent residents are taxed on Japan-source income and any income paid in Japan. Lastly, non-residents are taxed on Japan-source income only.

Japan has a progressive tax system. For 2013, tax rates on employment income range from 5% to 40%.

Japan and the U.S. have an income tax treaty in-place. International tax treaties clarify tax jurisdiction. These treaties can provide U.S. citizens and residents with reductions in foreign income taxes. However, a reduction in U.S. taxes is generally not available under these treaties as a result of “tax saving” clauses that allow the U.S. government to impose taxes on U.S. expats as if there were no treaty.

Japan and the U.S. also have a social security tax agreement in-place. Therefore, you can avoid dual-taxation.”

How Living in Japan Impacts US Taxes

As a U.S. citizen or permanent resident (Greencard), you are required to file U.S. taxes even if you live in Japan. Plus, if you have assets in foreign financial accounts (e.g., foreign banks), there are informational reports you may be required to file. For example, U.S. Expats Living in Japan with $10,000 or more in foreign banks must file the FBAR (now known as FinCen 114).

Fortunately, the U.S. government provides various forms of tax relief that can lower or eliminate U.S. tax obligations

- The Foreign Earned Income Exclusion – It allows you to exclude a certain amount of income earned outside the U.S.

- The Foreign Housing Exclusion/Deduction – This one relates to additional income that can be excluded for household-related expenses tied to living abroad.

- The Foreign Tax Credit – It allows you to offset foreign taxes paid against U.S. tax obligations.

In most cases, the foreign earned income exclusion is preferable to the foreign tax credit if you live in a country with a lower tax rate than the U.S. (assuming your income is not above the applicable threshold). However, it’s a good idea to speak with an expat tax specialist to discuss the best application of these tax reliefs.

FATCA and Japan

The U.S. government is increasingly interested in knowing about the foreign assets held by its citizens and residents. As a result, it has been busy inking deals with other countries whereby foreign financial institutions (FFIs) will be required to:

- Identify accounts of U.S. persons;

- Report certain information to the IRS regarding those accounts;

- Withhold a 30% tax on certain payments to non-participating FFIs and account holders unwilling to provide the required information

As of the publication of this article, roughly 100 countries have either signed intergovernmental agreements with the United States or are in discussions. It is important to know that Japan does have a FATCA agreement in-place with the U.S.

If you have any questions regarding your U.S. expat taxes, contact us today. We are here to help.